In context: With the global PC market continuing to recover from a years-long slump, processor makers Intel and AMD are reportedly increasing their CPU shipments year-over-year, even as they see a drop in sales sequentially. The server market, however, remains sluggish, with server CPU shipments registering a double digit fall compared to last year.

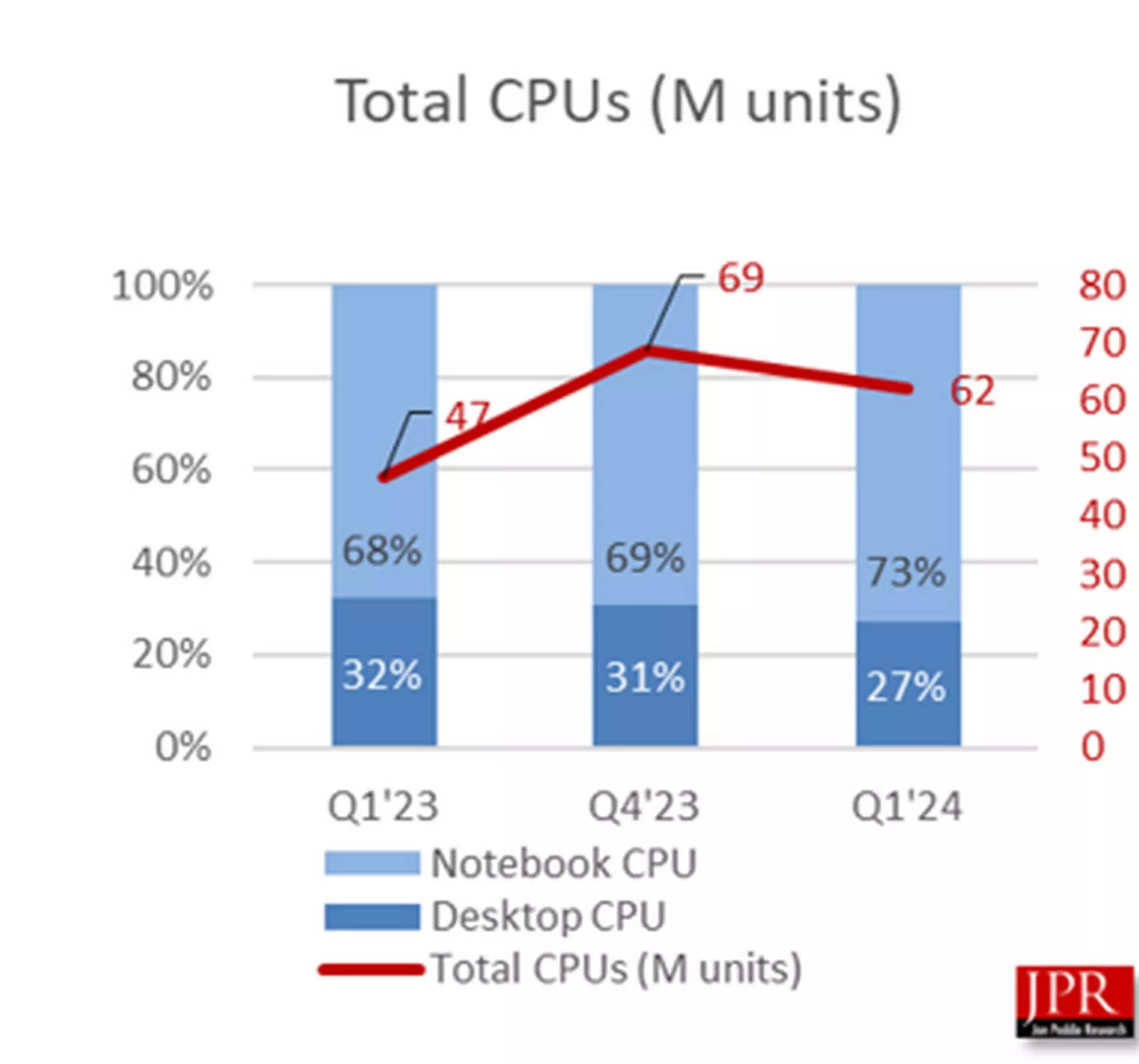

According to a new report from Jon Peddie Research (JPR), the client PC CPU market reached 62 million units in Q1, 2024, representing a healthy 33 percent growth from the same period last year. However, the shipments are still down 9.4 percent sequentially from Q4, 2023, when the manufacturers shipped 69 million units globally.

Total iGPU shipments, which hit 56 million units last quarter, also show a similar trend. While it grew 30 percent year-over-year, it still represents a reduction from Q4, 2023 which saw the shipment of 62 million units. Looking forward, the report predicts that iGPU penetration in the PC sector will grow significantly to reach 98 percent.

Another interesting trend confirmed by the report is the increasing preference for laptops among most PC users. While demand for notebooks has far outstripped desktop sales for years, the latest data suggests that this is now more pronounced than ever. In Q1 2024, desktop processors accounted for 27 percent of the market, down from 32 percent in Q1 2023, as mobile CPUs increased their market share from 68 percent to 73 percent.

Meanwhile, despite the growth in client PCs, it’s not all good news for companies like Intel and AMD. According to the report, server CPU shipments fell 13 percent from last quarter and as much as 17 percent from the same period last year, suggesting server farms and data centers are not upgrading as fast as the PC hardware industry would want.

According to JPR president Jon Peddie, the latest results took many analysts and investors by surprise, as they expected the sequential growth to continue for at least a few more quarters. Peddie expects the Q2 numbers to remain weak, but believes that it could be a good thing in the long run, as it’s an indication that the market has stabilized and returned to its “traditional cyclic behavior.” The industry as a whole, however, will hope that the market returns to growth sooner rather than later.