What If…? Imagine your company has a supplier that has gone through some hard times. Management made some bad decisions years ago, the company struggled, lost its way in the market. Then that vendor got a new CEO who pledged to turn the company around, fix their operations, make their products more competitive. Nobody knows if they can really turn it around, but as a customer, you have better knowledge about how they are doing. Their sales people are calling regularly, showing off their latest products. Would you buy their stock? The SEC might have something to say about that, but what if instead of buying stock in the company you buy the whole company?

We thought of this the other day when speaking with an investor about Intel and the potential for someone to buy them. As we noted, Intel faces a dilemma right now – it looks to be turning the corner, but we will not see those results publicly for a few years.

Editor’s Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

In the interim, their stock is likely to remain under pressure, especially if they continue communicating the way they have been. The key question for the company is its ability to close the gap with TSMC in its manufacturing process. That is an incredibly expensive proposition, and no one is likely to acquire them until this is de-risked.

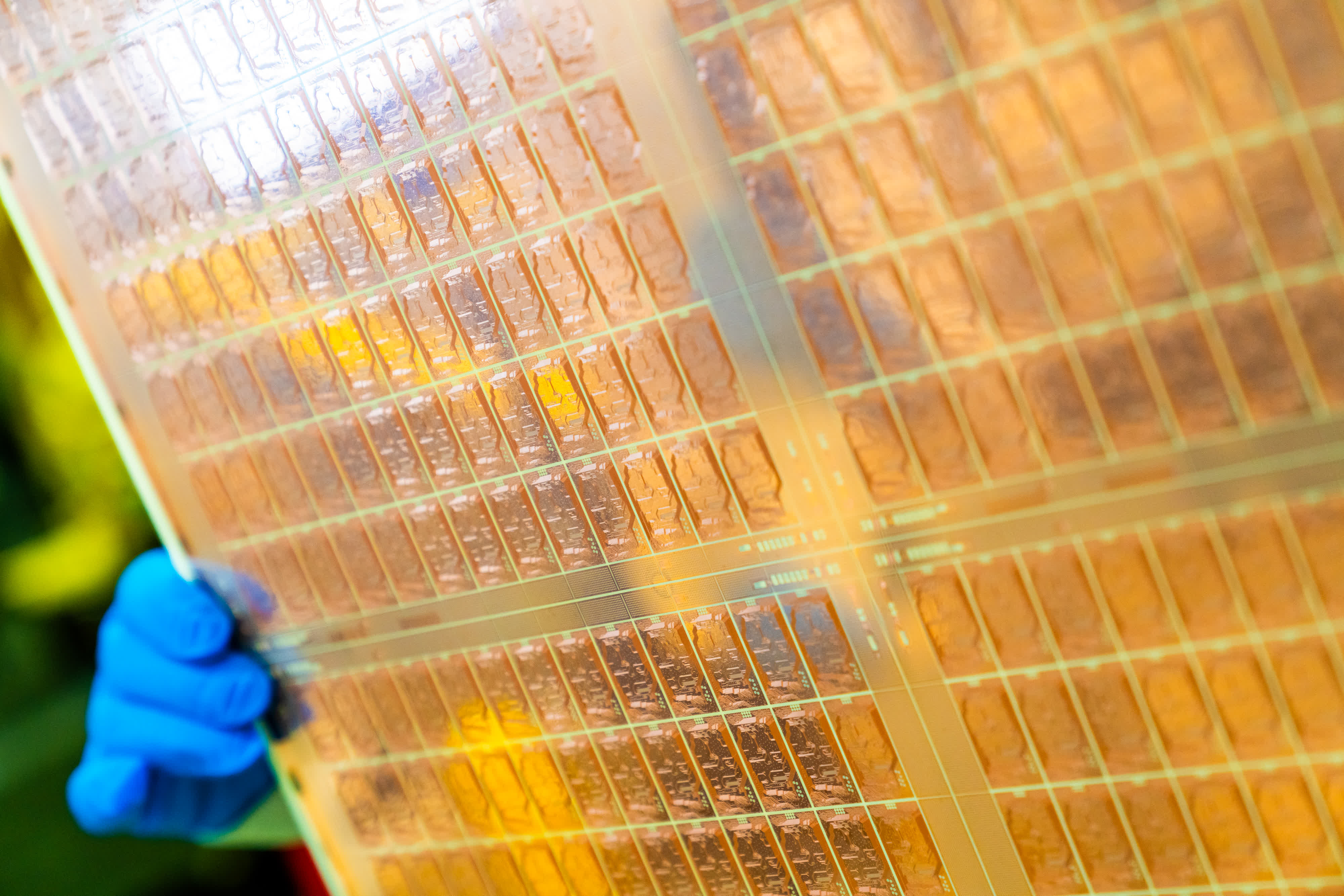

The trick here is that Intel is out there trying to gin up business for Intel Foundry, and so all those potential customers will be able to see for themselves how good Intel’s manufacturing actually is. And they will likely know this a year before the investing public does. If Intel’s stock remains depressed during that time, they might be vulnerable to a takeover.

Of course we are just wildly speculating here. Intel remains a massive company, requiring massive amounts of capital to keep moving. There are very few companies large enough to be able to afford it, even at depressed levels.

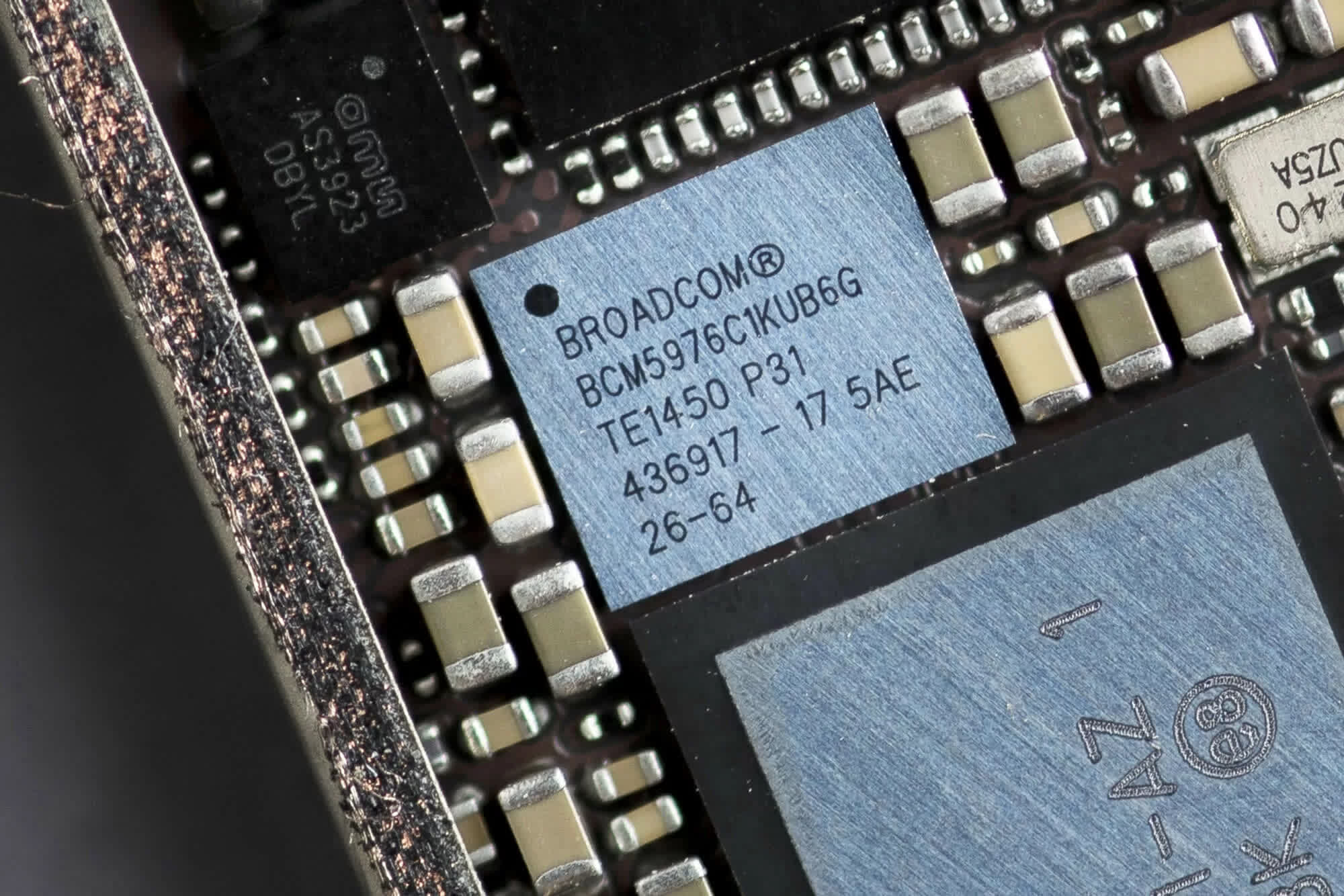

We think it is unlikely that Broadcom would buy Intel, but they could. And they will know before any of us how sustainable Intel’s turnaround is.

That being said, there is one company that could pull it off – Broadcom, the industry’s arch-acquirer. The math seems to work. Broadcom last year generated $28 billion in semis revenue, at what we estimate is about 70% gross margins (!!!).

That works out to about $8 billion in cost of goods sold. Assuming that most of that goes to TSMC and their ~50% gross margins, if Broadcom could transition all of its products to an internal fab, that would mean about $4 billion in savings, which gets us a long way towards a 10% return on investment for Broadcom.

There are other complexities, of course. The obvious one is, can Broadcom afford a deal of this size? And the equally obvious answer is, yes. It would be their biggest deal, but this is a company built on the premise of ever-larger acquisitions.

We have not run the credit metrics on the deal, but we are pretty sure Hock Tan is good for it. Another reality is that moving everything from TSMC to Intel is not a trivial process, it would take years, but that falls under the category of post-merger acquisition and Broadcom has a pretty rigorous process for aligning everyone’s incentives really quickly.

Also read: What has Broadcom become?

And yes, there will be regulatory scrutiny, but the overlap between the two is fairly small and Broadcom is now a US company. We can also hear many people arguing that “Broadcom is done with semis, they are a software company now,” but this misses the fundamental point that Broadcom is neither a semis company nor a software company, it is a private equity fund.

The biggest problem with the deal is that cost savings only go part of the way in delivering a return.

Broadcom only wants to buy businesses that throw off a lot of cash, and Intel has been burning operating cash for a while now. Which brings us back to where we began. If (when) Intel turns the corner, it should enjoy massive operating leverage. They are investing heavily right now, but when (if) their manufacturing process kicks into gear, they should start to throw off a lot of cash. Broadcom will know well before any of us how likely that is to happen.

Granted, this is all conjecture, but we think it highlights a good reason for Intel to become more circumspect in how it communicates to the Street. This scenario may not be likely, but it is definitely possible.